DeepAlpha

DeepAlpha is a quantitative research firm applying scientific techniques, AI, and Quantum Computing to find patterns in large, noisy real-world financial data sets for making smart decisions. It provides data-driven portfolio management services for subscribed clients. The company was co-founded by an NYU professor and DeepMind ML Engineer.

Starting from May 2022, I was working in this firm as an Quantitative Researcher and Software Developer. I developed algorithms for portfolio management based on finanical-principle-aware Reinforcement learning, which became a core part of company’s own code base. I also collaborated with Software Development team, and we successfully built an end-to-end trading pipeline including financial data processing, Alpha factor engineering, ML model selection, strategy back testing, paper trading and online trading.

Here is a blurred screenshot of the trading pipeline we developed during my time-consuming but interesting work here, and it is a complete and robust pipelines (much less bugs than FinRL >.<):

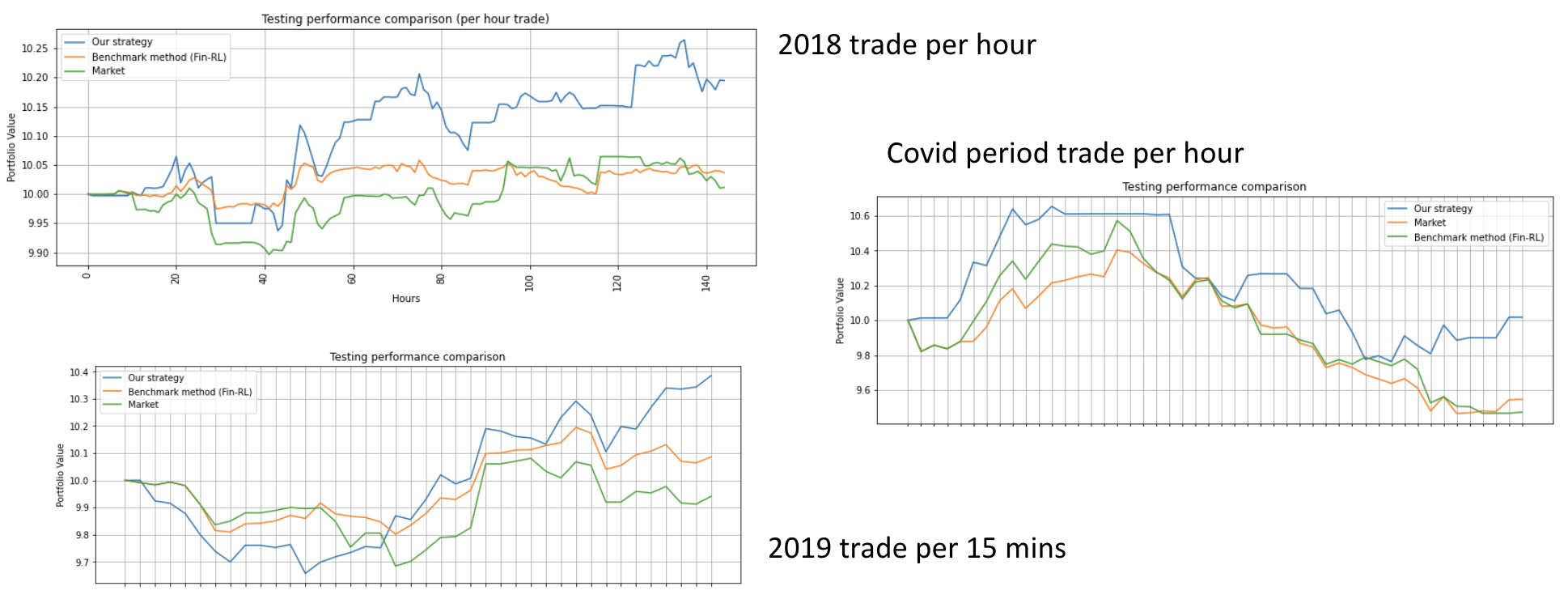

Also, we already did some intial testings on the customized RL algorithms that I developed over 6 months. Here is some particular results during backtesting:

We can see that the algorithms that I developed outperformed the market as well as famous FinRL packages built-in models in terms of portfolio value for testing period !! Besides, our modelled succeed to not losing or even making a little bit during Covid period.

We can see that the algorithms that I developed outperformed the market as well as famous FinRL packages built-in models in terms of portfolio value for testing period !! Besides, our modelled succeed to not losing or even making a little bit during Covid period.

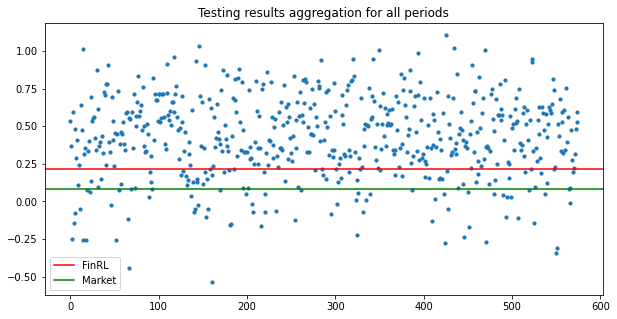

We extend this testing to more periods, and plot the testing period Sharp Ratio for all the periods, and compare them with average result for FinRL model Sharp ratio and the market Sharp ratio:

We will keep pushing at DeepAlpha.

We create our own luck.